do nonprofits pay taxes in canada

Human Resources Coordinator. If your NPO has received or is eligible to receive taxable dividends interest rent or royalties worth more than 10000 you have to file an information return.

The New Canada Recovery Hiring Program Crhp Fbc

In Paragraph 1491f a registered charity can avoid paying income tax after acceptance.

. Find more information at About alternate format or by calling 1-800-959-5525. This guide is for you if you represent an organization that is. While nonprofits typically will not have to pay taxes they still have to submit annual tax returns with the IRS.

In accordance with the type of nonprofit organization the value of its assets and other factors nonprofit organizations must file their tax returns. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

A nonprofit that identifies as a 501. Nonprofit organizations are distinguished from charities by the Act whereas corporations are allowed to seek Registration with Canada Revenue Agency. Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairment.

Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax ActNot-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency. This is an introductionAs a result of being exempt from income tax through the Income Tax Act Canada ITA not-for-profit organizations and charities are often subject to property taxTherefore for charitable organizations that arent profit-making the interpretation of. Being tax exempt means an organization doesnt pay federal taxes but they still have to provide the IRS with the information they need.

But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer. Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors. This is true for any nonprofit no matter their status.

By QuickBooks Canada Team. A company cannot acquire tax exempt status unless a federal. March 29 2017 2 min read.

Yes nonprofits must pay federal and state payroll taxes. Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations often face heavy financial penalties associated with property taxes. Non-profit organization Canada.

Income tax and not-for-profits. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act. Do Nonprofits Have To File Tax Returns In Canada.

A Canadian nonprofit would not need to pay income tax but they have to use the Canada Revenue Agency in filing their returns. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. There is no requirement provincially federally or within tax law that non-profit organizations have a particular legal form meaning they may be corporations trusts or unincorporated associations.

Do Not For Profits Pay Taxes In Canada. 48127 USD 47576 CAD Recruitment hiring screening compensation and workplace safety are vital to developing a nonprofit team. Non-profit organizations whose primary purpose and operation is related to the promotion of amateur athletics in Canada is exempted from this rule.

Charities and not-for-profits ought to ask themselves whether property taxes apply to. Not-for-profits that are not registered charities may also have to file. Do Nonprofit Organizations Pay Property Taxes In Canada.

The Human Resources Coordinator is responsible for overseeing these facets of a nonprofit organization and establishing a team culture. GSTHST Information for Non-Profit Organizations. CRA Registered charity vs.

Your recognition as a 501 c 3 organization exempts you from federal income tax.

Pin By Muskoka Language International On Visit Salmon Arm With Mli Salmon Arm Chamber Of Commerce Learn English

Simple Ways To Start A Nonprofit In Canada With Pictures

Habitat For Humanity On Twitter Habitat For Humanity Habitats Improve

Best Grants And Funding For Non Profits In Canada

Simple Ways To Start A Nonprofit In Canada With Pictures

Simple Ways To Start A Nonprofit In Canada With Pictures

Infographic On Charitable Giving In Canada From Imagine Canada Http Www Imaginecanada Ca Node 802 Infographic N Charitable Giving Infographic Charitable

Simple Ways To Start A Nonprofit In Canada With Pictures

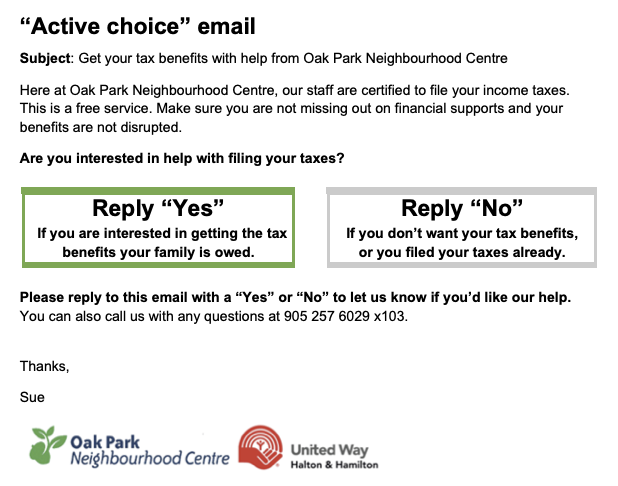

How Behavioural Insights Helped Canadians Access Their Tax Benefits The Behavioural Insights Team

Giving To U S Charities The Canada U S Tax Treaty Not A Simple Process Sadovnick Morgan Llp

Simple Ways To Start A Nonprofit In Canada With Pictures

Best Grants And Funding For Non Profits In Canada

Simple Ways To Start A Nonprofit In Canada With Pictures

How Behavioural Insights Helped Canadians Access Their Tax Benefits The Behavioural Insights Team

How Far Does 100 Go In Your State Map Cost Of Living States

Intuit Quickbooks Desktop Pro Plus 2021 With Payroll Enhanced 1 Year Subscription Windows Digital Quickbooks Payroll Accounting Software

State Gasoline Tax Rates By The Tax Foundation Infographic Map Safest Places To Travel Fun Facts