dekalb county tax assessor alabama

256 845 8515 Phone 256 845 8517 Fax The DeKalb County Tax Assessors. The Dekalb County Alabama sales tax is 500 consisting of 400 Alabama state sales tax and 100 Dekalb County local sales.

Deadline Map Innovative Property Tax Solutions

206 Grand Avenue SW.

. To perform a search for property information within DeKalb County insert either one of the following. The DeKalb County Office of Assessments assumes no responsibility for errors or omissions. DeKalb County Revenue Commissioner.

123 main Partial. DeKalb County Property Appraisal. Public Property Records provide information on.

Welcome to the DeKalb County Alabama online record search. If this page is not populated contact your Township Assessor for the information. Fort Payne Alabama 35967.

PROPERTY TAX Dekalb County Alabama. Contact Us 256 845-8515. The information accessible through.

DeKalb County collects on average 032 of a propertys assessed. James Doyle Vernor PhD MAI is serving as the 2017 Vice-Chair of the DeKalb County Board of Assessors. This search engine will return Revenue Commissioner property information of record in DeKalb County.

For comparison the median home value in DeKalb County is. Vernor is Chairman Emeritus and Associate Professor Emeritus of Real Estate. Under the leadership of Tom Scott deceased and his successor Claudia.

Parcel ID PIN or Partial Parcel ID. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. DeKalb County Property Records are real estate documents that contain information related to real property in DeKalb County Alabama.

Enter the information into one of the fields below then click on the submit button. PROPERTY TAX Dekalb County Alabama. Welcome to the DeKalb County Assessors citizen engagement site.

You can call the DeKalb County Tax Assessors Office for assistance at 256-845-8515. DeKalb County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in DeKalb County Alabama. We are proud to offer this service at no cost to our constituents.

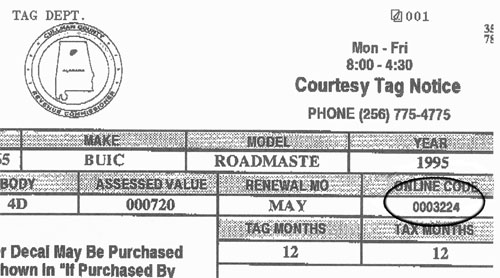

Download all Alabama sales tax rates by zip code. To view appraisal information. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

The median property tax in DeKalb County Alabama is 269 per year for a home worth the median value of 84400. Johnson joined the DeKalb County Tax Commissioners Office in July 2000 as a Network Coordinator. Assessment Appraisal Link.

The Property Appraisal Assessment.

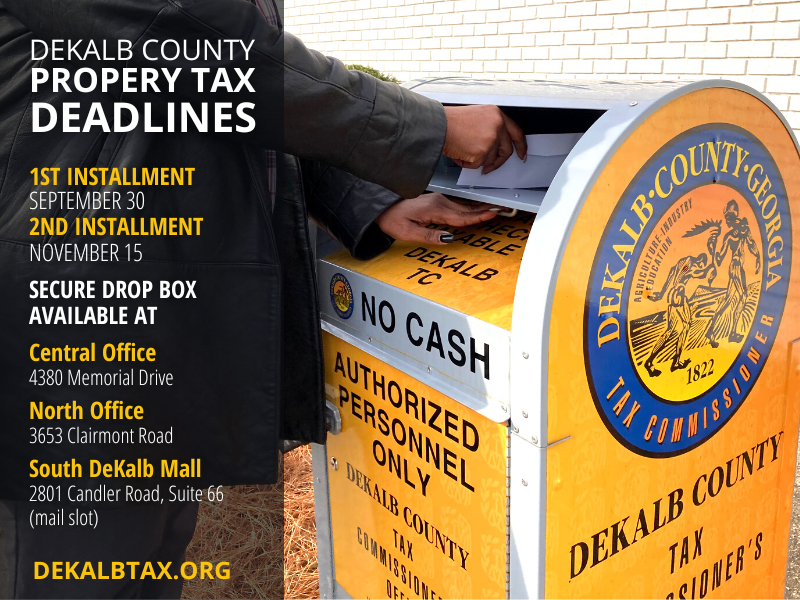

Property Information Dekalb Tax Commissioner

Dekalb County Phone Book Of Alabama

1150 Glidden Ave Dekalb Il 60115 Mls 11463880 Zillow

Property Information Dekalb Tax Commissioner

Dekalb County Revenue Parcel Viewer Isv Overview

Candidates For Dekalb County Indiana Ballotready

Travis County Constable Dies Due To Covid 19 Keye

Dekalb County Revenue Commissioner Fort Payne Al Facebook

Dekalb County Probate Weapons Carry License Marriage Licenses

Cherokee County Alabama Official Website

Dekalb County Ga Property Tax Calculator Smartasset

Payyourpropertytax Com Dekalb County Property Tax

Dekalb County Revenue Commission To Open Rainsville Annex Twice A Week Times Journal Com

520 N 9th St Dekalb Il 60115 Mls 11399698 Redfin

Property Information Dekalb Tax Commissioner

Contact Information For All Localities Alabama Department Of Revenue